U.S. Treasury Exposes Turkey as Hub for Hezbollah Sanctions Evasion

Nordic Monitor reports on how new U.S. Treasury designations reveal Turkish-registered companies at the center of Hezbollah's sanctions evasion network

On February 10 2026, the U.S. Department of the Treasury designated a network of companies and individuals spanning Turkey, Lebanon, Iran, Russia, and Panama for generating revenue and evading sanctions on behalf of Hezbollah. The sanctions, issued by the Office of Foreign Assets Control (OFAC), target two distinct financial lifelines: an international procurement and commodities shipping operation that routed millions of dollars in Iranian fertilizer through Turkey using falsified documents, and a gold exchange company in Lebanon that converted Hezbollah’s reserves into usable cash.

According to a detailed report by Nordic Monitor, Turkish trade registry records reviewed by the outlet expose the corporate genealogy of the Turkish firms involved, revealing how Hezbollah operatives and their associates set up and capitalized companies on Turkish soil — in some cases obtaining Turkish citizenship in the process.

Falsified Origins, Turkish Front Companies

The Treasury stated that in late 2025, Hezbollah’s Iran-based finance team member Ali Qasir — previously designated by the U.S. — coordinated with a web of associates to export millions of dollars’ worth of Iranian fertilizer to Turkey. The operation used Istanbul-registered Platinum Group International Dış Ticaret Limited Şirketi to facilitate the transaction, with shipping documents falsified to claim the cargo originated in Oman rather than Iran.

Nordic Monitor reports that Platinum Group was established in August 2024 by Turkish national Murat Aslan with capital of 30 million Turkish lira — a company that, within roughly a year of its founding, was being used to move sanctioned Iranian goods.

The shipping chain relied on Turkey-based Sea Surf Shipping Limited, which owns the Saint Kitts and Nevis–flagged cargo vessel LARA. The fertilizer was loaded onto the Panama-flagged BRILLIANCE, owned by Panama-based Brilliance Maritime Ventures S.A. — a vessel the Treasury identified as part of a fleet managed by the Islamic Revolutionary Guard Corps-Quds Force (IRGC-QF) and Hezbollah-affiliated Syrian businessman Abdul Jalil Mallah.

The operation also involved previously sanctioned individuals including Samer Kasbar, director of Hezbollah front company Hokoul SAL Offshore, and Syrian businessman Yaser Husayn Ibrahim.

The Previously Sanctioned Turkish Company Still in Play

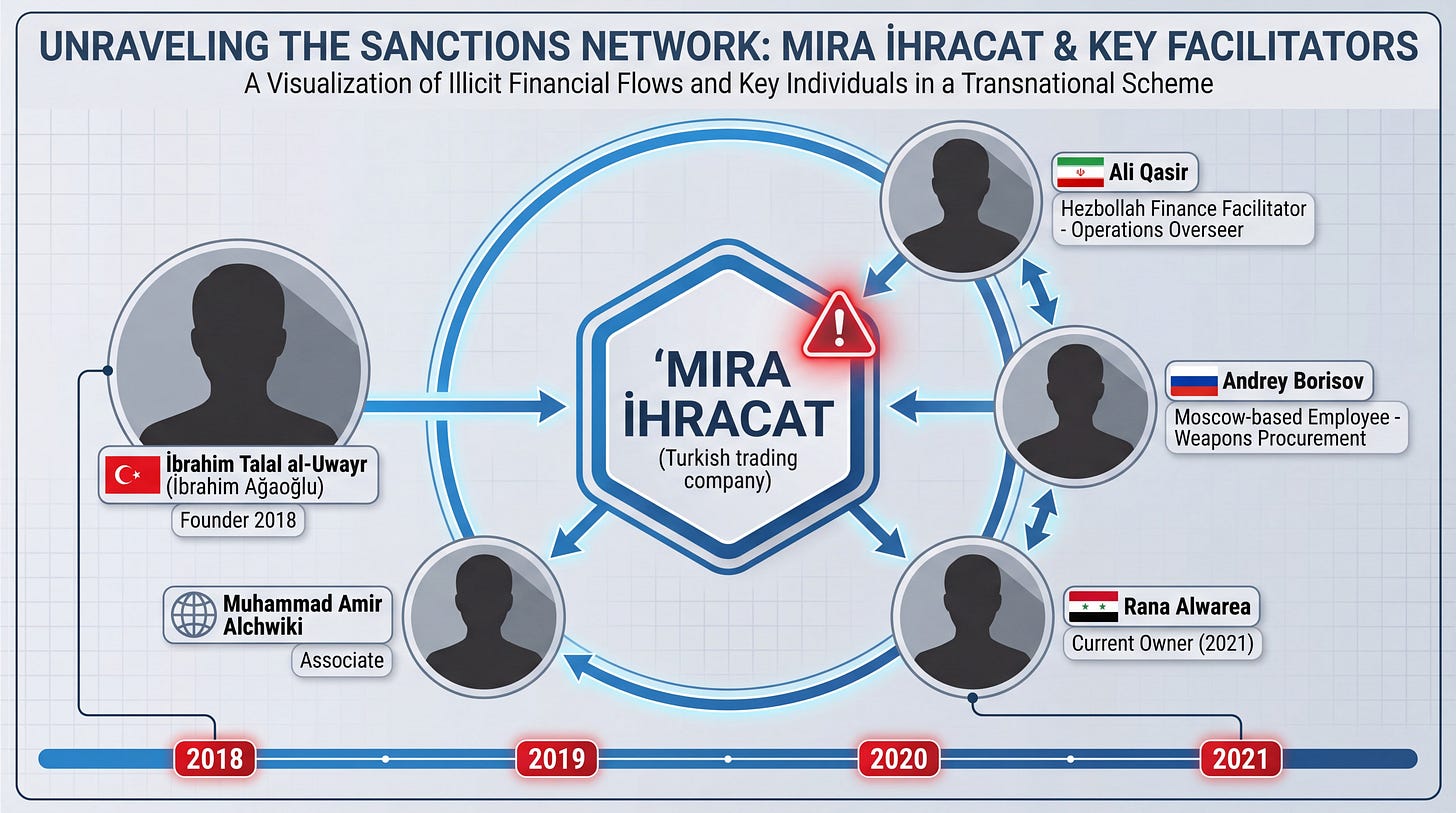

A central node in the network is Mira İhracat İthalat Petrol Ürünleri Sanayi Ticaret Limited Şirketi, a Turkish trading company first sanctioned by OFAC in January 2024 for purchasing, transporting, and selling Iranian commodities on behalf of the IRGC-QF and Hezbollah financial operatives. Despite that designation, the company’s infrastructure continued to be leveraged by sanctioned actors.

According to Nordic Monitor’s review of Turkish trade registry data, Mira was established in December 2018 in Istanbul by Ibrahim Talal al-Uwayr, who subsequently acquired Turkish citizenship and assumed the Turkish name İbrahim Ağaoğlu. The company’s activities are overseen by Ali Qasir, the same Iran-based Hezbollah finance facilitator who orchestrated the fertilizer scheme. In March 2021, the company was transferred to Syrian national Rana Alwarea. In September 2024 — eight months after being sanctioned by the U.S. — its capital was increased to 7.5 million Turkish lira.

The February 2026 sanctions newly designated Russian national Andrey Viktorovich Borisov, described as a Moscow-based Mira employee who worked directly with Ali Qasir on projects including procuring weapons from Russia and selling commodities to generate revenue for Hezbollah. The Treasury stated that Borisov has collaborated with al-Uwayr and another previously designated associate, Muhammad Amir Alchwiki, on Mira-related business deals involving Russia since at least 2021.

Hezbollah’s Parallel Financial Channel

OFAC also targeted Jood SARL, a Lebanese gold exchange firm that functions as a front for al-Qard al-Hassan (AQAH), Hezbollah’s quasi-banking operation that holds an NGO license from Lebanon’s Ministry of Interior but in practice provides full financial services to the militant group. Amid growing liquidity constraints from throughout 2025, AQAH moved to set up a network of gold trading entities, with Jood serving as one of the vehicles to liquidate the organization’s gold holdings into cash.

Two senior AQAH figures, Mohamed Nayef Maged and Ali Karnib, jointly own and manage Jood. The Treasury noted that the company’s branches, located across Beirut, the Bekaa Valley, and Nabatiyeh, are clustered around existing AQAH facilities. This represents a geographic footprint that mirrors Hezbollah’s territorial base.

A Pattern of Turkish Involvement

The latest designations build on a pattern Nordic Monitor has tracked: in May 2025, the outlet reported that Israel formally complained to the UN Security Council that Turkey was serving as a financial conduit for Hezbollah, citing cash-laden flights from Turkey to Beirut in early February 2025. Separately, in late February 2025, Lebanese authorities seized $2.5 million in cash from a man arriving from Turkey at Beirut’s airport, with sources telling Reuters the money was intended for Hezbollah.

Mira itself was first sanctioned in January 2024, when the Treasury designated an IRGC-QF and Hezbollah financial network that included the Turkish firm and its founder, al-Uwayr. Despite this, as Nordic Monitor’s trade registry findings show, the company’s capital was increased months after being placed on the U.S. sanctions list.

Sanctions Implications

The designations freeze any U.S.-linked assets of the named individuals and companies and prohibit U.S. persons from engaging in transactions with them. Foreign financial institutions that knowingly facilitate significant transactions on behalf of the sanctioned entities risk secondary sanctions, including potential restrictions on access to the U.S. financial system.

The sanctions package adds to a growing dossier of U.S. enforcement actions that place Turkey’s corporate and shipping infrastructure at the center of Iranian and Hezbollah-linked sanctions evasion. Whether Ankara will move to investigate or dismantle the Turkish companies named by the Treasury — particularly given that Mira continued to operate and increase its capitalization after its 2024 designation — remains an open question.