Palo Alto Networks to Acquire Israeli Cyber Startup Koi in $400M Deal

The planned Koi deal highlights Israel’s dominance in cybersecurity, as Tel Aviv University ranks 7th globally in universities producing startup founders.

On Tuesday, February 17, 2026, Palo Alto Networks announced its intent to acquire Israeli cybersecurity startup Koi in a deal reported at about $400 million. The purchase marks the Silicon Valley giant’s 12th Israeli acquisition since 2014 and underscores Israel’s central role in global cybersecurity, as international buyers poured a record $71 billion into Israeli tech in 2025.

What is Koi? The One-Year-Old Startup Behind the $400M Deal

Koi represents a remarkable success story even by Israeli tech standards—founded in 2024 by three veterans of the IDF’s elite Unit 8200 intelligence corps technology unit, the startup raised only $48 million before being acquired for $400 million just one year later.

The company was born from a bold security experiment: the founders created a fake software extension to prove a dangerous vulnerability existed, and within a week, over 300 organizations worldwide—including Fortune 500 companies and even a national court system—had unknowingly installed it, exposing their sensitive data.

Koi’s platform addresses a critical new security gap created by AI agents and automated tools that can access company systems and data but operate invisibly to traditional security software. Its technology acts as a central security checkpoint, analyzing and blocking risky software before it can infiltrate company networks—protecting over 500,000 computers across major corporations and financial institutions. Palo Alto had been using Koi’s technology internally since mid-2025 before deciding to fully acquire the company, viewing it as essential to defending against AI-driven cyber threats.

A 12-Year Israeli Buying Spree

The Koi acquisition represents more than just another deal for Palo Alto Networks, it’s the latest chapter in a strategic pattern that has seen Israeli startups feature at the center of the company’s expansion into cloud security, endpoint protection, DevSecOps, and identity management.

Since acquiring Cyvera for $200 million in 2014, Palo Alto has systematically targeted Israeli innovation, completing major deals including Demisto for $560 million (2019), Twistlock for $410 million (2019), Talon Cyber Security for $625 million (2023), and Dig Security for $400 million (2023).

The crown jewel came in 2025 with the $25 billion cash and stock acquisition of CyberArk, the second-largest Israeli tech exit ever. These 12 Israeli acquisitions account for half of Palo Alto’s 24 significant global deals since 2014.

Israel: More Than an Acquisition Target

Israel has become a central operational hub for Palo Alto Networks, not merely a source of acquisitions. Prior to the CyberArk purchase, the company employed approximately 1,600 people in Israel. The CyberArk deal added another 1,000 employees, and the company’s Israeli R&D center now occupies 22 floors of Tel Aviv’s Alon Tower.

During a December visit to Israel, CEO Nikesh Arora addressed concerns about the company’s commitment following founder Nir Zuk’s departure from day-to-day leadership. “Israel is not the simplest country to operate, and not the easiest people,” Arora said. “But it has some of the most passionate people, who can handle adversity better than most people in the world.”

Record-Breaking Year for Israeli Tech Exits

The Koi deal comes during an extraordinary year for Israeli tech. According to Startup Nation Central’s Q3 2025 report, Israeli tech companies recorded $71 billion in M&A activity across the first three quarters of 2025, nearly five times higher than the same period in 2024.

PwC Israel’s annual exit report revealed that tech exits, including M&As and IPOs, jumped 340% to $58.8 billion from January through November 2025, up from $13.4 billion in 2024. Calcalist estimates the full-year figure reached approximately $80 billion.

The surge was driven by megadeals beyond Palo Alto’s acquisitions, including Google’s record-breaking $32 billion purchase of cloud security startup Wiz, ServiceNow’s $7.75 billion acquisition of Armis, and Xero’s up-to-$3 billion deal for fintech company Melio.

Israel’s Broader Tech Dominance

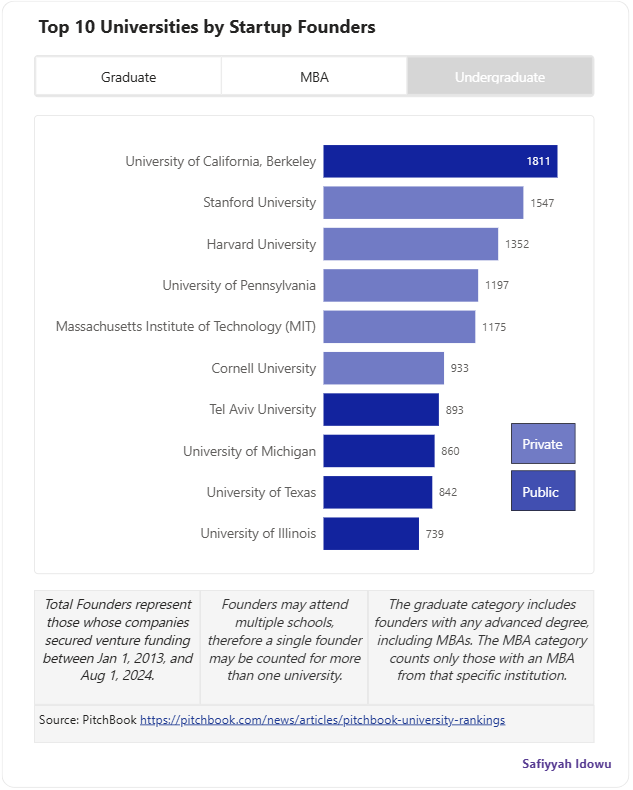

Israel’s cybersecurity prowess extends beyond M&A activity. According PitchBook’s report released in September 2025, Tel Aviv University ranks 7th globally in producing startup founders. Technion – Israel Institute of Technology ranks 10th. The nation is one of only seven countries worldwide with a locally developed model featured among the top 200 AI models globally, with Israeli company AI21 Labs' Jamba Large 1.7 ranking just 11.6 months behind OpenAI's leading GPT-5.

“Israel is among the world’s leading countries in infrastructure, models, and implementation,” said Michal Braverman-Blumenstyk, Microsoft Corporate Vice President, CTO of Microsoft Security, and Managing Director of the Microsoft Israel R&D Center.

What’s Driving the Israeli Advantage?

Industry experts attribute Israel’s outsized tech influence to several factors: mandatory military service that produces highly skilled cybersecurity talent, particularly from elite intelligence units; a culture of innovation and risk-taking; strong government support for R&D; and world-class universities producing entrepreneurial founders.

Despite ongoing regional conflicts, Israeli startups raised $15.6 billion in private funding in 2025, up from $12.2 billion in 2024, according to Startup Nation Central data.

As Arora emphasized during his Israel visit: “I have never found the team from Israel not willing to accept feedback and desire to build the best product in the world, that trumps everything.”

Why can't it be kept in house of Israel? I just don't think all American companies purchasing Israeli companies is so very wise, when so many of American companies have been bought to not do good only bad.